UAE’s Vision

This strategic decision is motivated by the UAE’s vision to reduce reliance on oil-related revenues and create a more sustainable and diversified economy. The introduction of corporate tax is governed by the Ministry of Finance, which plays a pivotal role in developing and implementing the tax framework, supported by the Federal Tax Authority (FTA) – responsible for administering and enforcing the corporate tax regulations, ensuring compliance among businesses operating within the UAE.

This joint effort demonstrates the UAE’s determination to create a fair and transparent taxation system, fostering economic stability and integration as well as attracting investment to fuel long-term growth in a fair and equitable business environment.

UAE’s Aim

It is important to note that the implementation of a corporate tax in the UAE is gradual and phased, with specific sectors and criteria identified for taxation while others are exempted. The government aims to strike a balance between generating tax revenue and maintaining the UAE’s attractiveness as a business-friendly destination keeping the corporate tax at 9%, hence falling within the group of countries with lowest Statutory Corporate Income Tax Rates. The 9% CT is significantly lower than the worldwide average statutory corporate income tax rate, measured across 180 jurisdictions to be 23.37 percent.

UAE Corporate Tax Remains Competitive

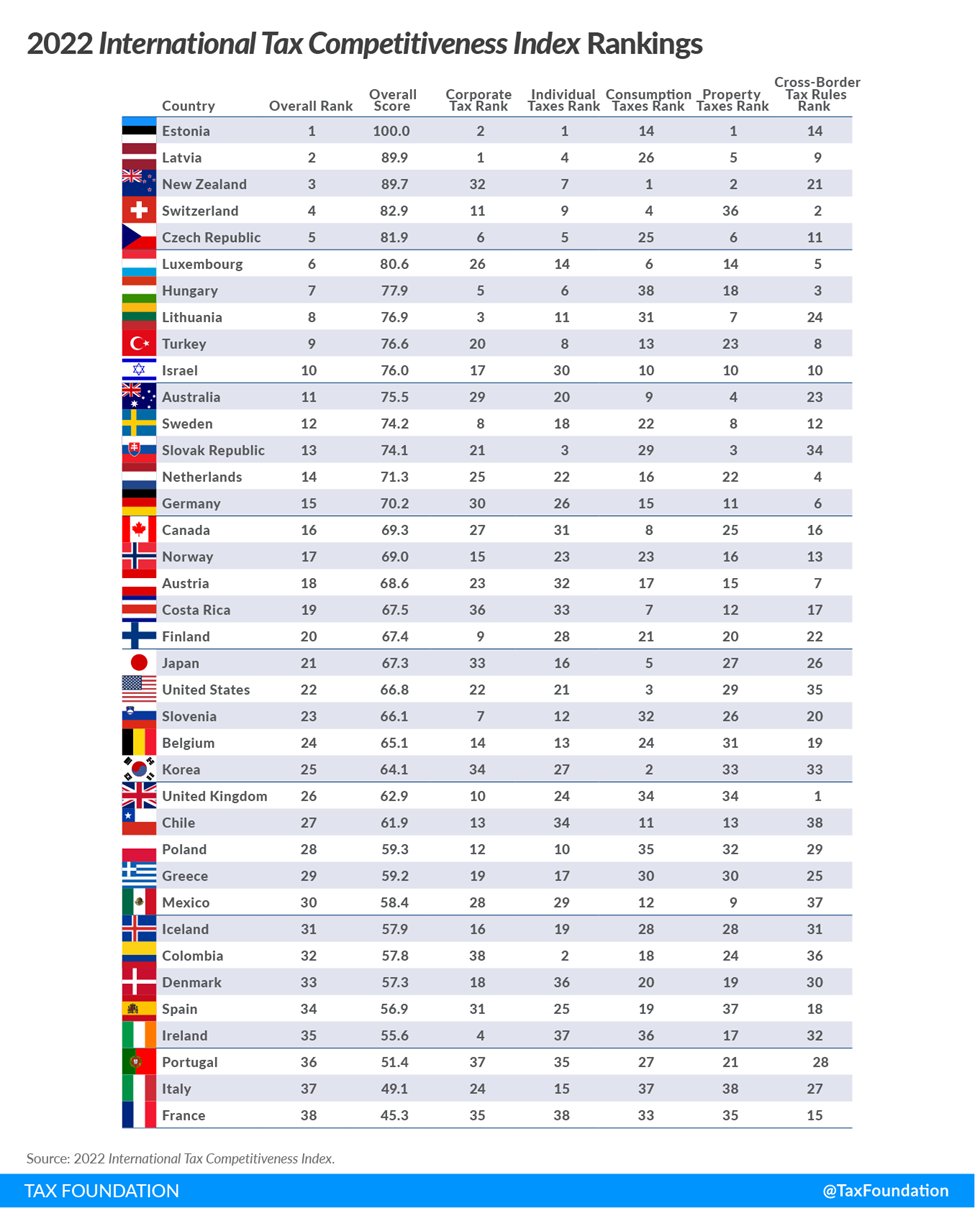

Even with Corporate Tax being introduced in addition to the Value Added Tax of 5% in effect as of 2018, the UAE tax system remains very competitive on the world stage due to other tax policy variables used to calculate the International Tax Competitiveness Index like individual income taxes, consumption taxes, property taxes, treatment of profits earned overseas.

The Tax Foundation has shared the 2022 International Tax Competitiveness Index ranking. The information gives a comprehensive overview of how developed countries’ tax codes compare, explains why certain tax codes stand out as good or bad models for reform, and provides important guidance to investors and insight into how to think about tax policy when choosing a destination to branch out or start business.

Excluding OECD’s Reform of International Taxation (Pillar 2)

Another very important element to be highlighted is that UAE Corporate Tax Law is introduced as of 1 June 2023 excluding the OECD’s reform of international taxation known as Pillar 2. Even though the EU member states reached an agreement to implement OECD’s reform of international taxation with minimum taxation component, known as Pillar 2, UAE has not released an adoption proposal at this stage. While Pillar 2 aims to reduce the risk of tax base erosion and profit shifting and ensure that the largest multinational groups pay the agreed global minimum rate of corporate tax, it is estimated by OECD and IMF that this shall have further implication on the Corporate Tax revenue raising it between 9% and 5.7%. Introducing Corporate Tax Framework that falls into the lowest Statutory Corporate Income Tax Rates and not featuring Pillar 2 certainly increases the competitive business position of the UAE on the international stage, reinforcing its position to attract foreign investment even though as of 1 June 2023 it will transition from zero income tax regime to a low CT bracket.

Referring to the International Tax Competitiveness Index ranking – what investors ultimately look at is a tax code that is competitive and neutral, promotes sustainable economic growth and investment opportunities, while still raising sufficient revenue for government priorities – such as security, infrastructure, standard of living, transparency, and legislative support.