Cross-border credit collaboration has a rich history rooted in the growth of global trade and financial interconnectedness. It refers to the practice governments adopt towards collaboration in facilitating lending and borrowing activities across international borders for the benefit of individuals and corporates relocating their place of residence/domicile. This concept has gained significant traction in recent decades due to the rapid digital and technological advancements that have and continue to have a transformational impact on the financial system reshaping it towards flexible business models, transparence, inclusion, and ease of use. The nature of the employment market post-Covid, rapidly shifting towards flexibility and liberation in practicing one’s profession from anywhere in the world is another strong element that has accelerated the need for establishing and growing the ecosystem of cross-border credit collaboration.

For individuals settling down in the UAE, the introduction of cross-border credit collaboration shall offer immediate financial inclusion/access to a wider range of financial services and opportunities, which previously were dependent on a credit score built over time by collecting data from multiple sources – like finance houses, banks, lending institutions, government agencies, telecommunication companies.

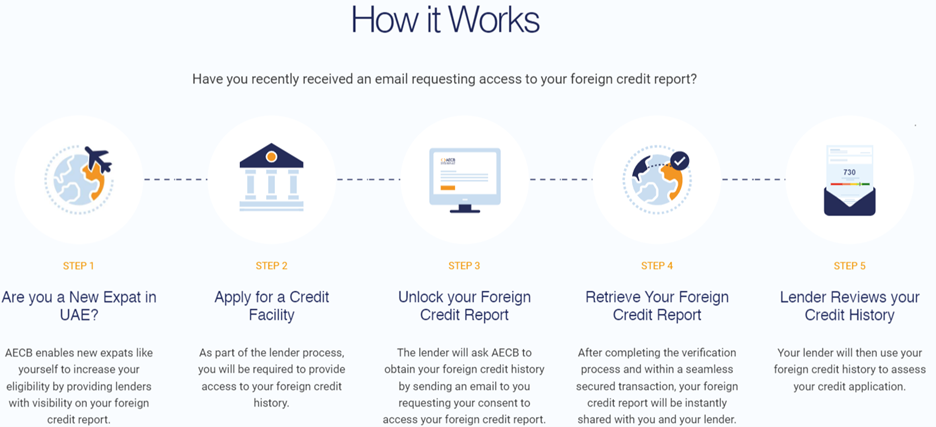

By reaching out to the Al Etihad Credit Bureau (AECB) both individuals and corporate applicants can now translate their international credit data into a UAE credit score and obtain a report needed in front of the UAE lending entities to allow them access to affordable credit to fund the education of their children, start businesses, invest in real estate or simply apply for credit cards.

For the financial institutions in the UAE it is an open door addressing a market segment that they have been forced to ignore because they couldn’t evaluate it properly due to lack of real time data.

For the UAE government, adopting cross-border credit collaboration translates into accelerated economic long-term social stability through attraction of foreign individual and corporate investments, encouraging business expansion and immediate integration of all newcomers looking to relocate and settle in the UAE.

*initially available for expatriates coming from India, the Philippines, and the United Kingdom, with other countries to be added in the near future.

This cooperation also encourages the transformation of the financial sector towards an ecosystem supporting a “borderless concept” and regulatory harmonization, leading to enhanced governance, and financial transparency while transforming risk management practices.

Al Etihad Credit Bureau

Al Etihad Credit Bureau is a Public Joint Stock Company wholly owned by the UAE Federal Government. The company was established as per UAE Federal Law No. (6) of 2010 concerning Credit Information and its amendments in Federal Decree Law No. (8) of 2020.

Al Etihad Credit Bureau is mandated to request and organize the collection, preservation, analysis, classification, use, and dissemination of credit information. The information is then presented in a variety of credit-related products in a fully digital process.

Credit reports in the UAE

Financial credibility for individuals and companies

A credit report is a document that includes your personal identity information, details of your credit cards, loans, and other credit facilities, along with your payment and bounced cheque history.

Credit reports in the UAE

The UAE provides official credit reports service for individuals and companies. These reports help applicants understand their debt levels and have a clearer picture of their financial obligations. This will in turn enhance their ability to plan for future borrowing and manage their finances responsibly.

How individuals can apply for a credit report?

- Visiting one of Al Etihad Credit Bureau customer service centers

- Provide original Emirates ID card and passport copy

- Payment method – credit/debit card or eDirham cards

How companies can apply for a credit report? Commercial credit reports are subject to the approval of the Al Etihad Credit Bureau legal department,

- Visiting one of Al Etihad Credit Bureau customer service centers

- Provide the original valid Emirates ID card of the firm’s owner or that of the authorized signatory

- An original valid trade license of the firm

- The original Articles of Association of the firm

- A valid email address

- Payment method – credit/debit card or eDirham cards

NOVA CREDIT

Nova Credit is a consumer-permission credit bureau with two products that help businesses make more fair and informed decisions on millions of ‘thin file’, no credit history, or new-to-country applicants. The Credit Passport® unlocks cross-border credit bureau data to help businesses underwrite new-to-country newcomer populations.

The company’s differentiated data sources and proprietary analytics are used by leading organizations like American Express, Verizon, HSBC, SoFi, and Yardi. Nova Credit is backed by investors including Kleiner Perkins, General Catalyst, Index Ventures, and Canapi as well as executives from Goldman Sachs, JPMorgan, and CitiThe initiative

Useful links:

- See steps required to get a credit report.

- What to do if your credit report contains incorrect Information?

- Sample credit report for individuals

- Sample credit report for corporates.